Common Stock Dividend Distributable Use Which Par Value

The standard par value for stock is 001. Wendell Company provided the following pertaining to its accounting year that ended December 31 2019Common stock with a 10000 par value was sold for 46000 cash Cash dividends totaling 21400 were declared of which 16400 were paid Net income was 66000 A 5 stock dividend resulted in a common stock distribution which had a 5000 par value and a 24400.

Ch 13 Homework-roujiun chen.

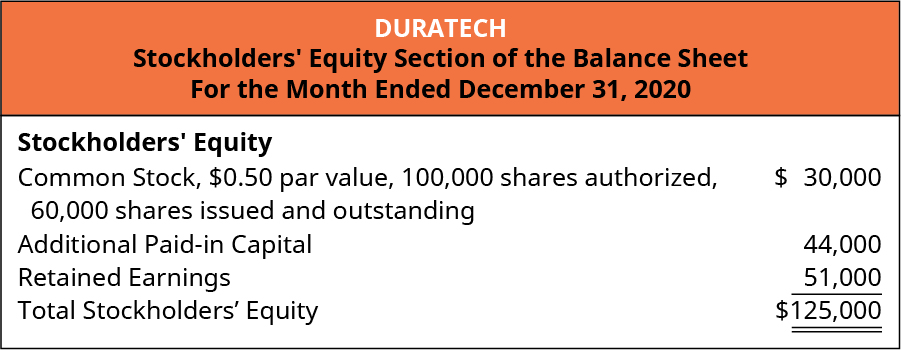

. A common stock dividend distributable is a dividend payable to the holders of a corporations common stock that has been declared by the entitys board of directors but not yet paid. Dividends distributable and paid-in excess of par-common stock. Paid-in Capital in Excess of Par Value Stock Dividends Common Stock Common Stock Dividends Distributable.

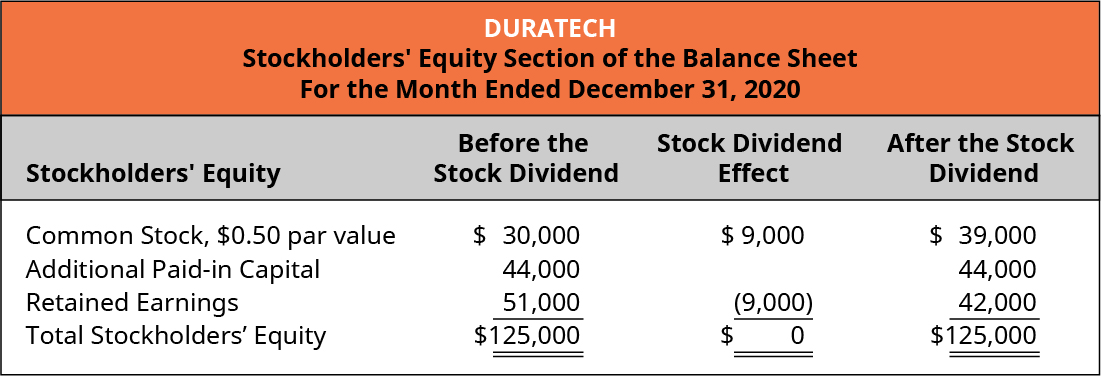

Total paid-in capital. A common stock dividend distributable appears in the shareholders equity section of a balance sheet whereas retained earnings balance sheet cash dividends distributable appear in the liabilities. Common Stock Dividends Distributable is a stockholders equity account not a liability o Stock dividends change the composition of stockholders equity but total equity remains the same.

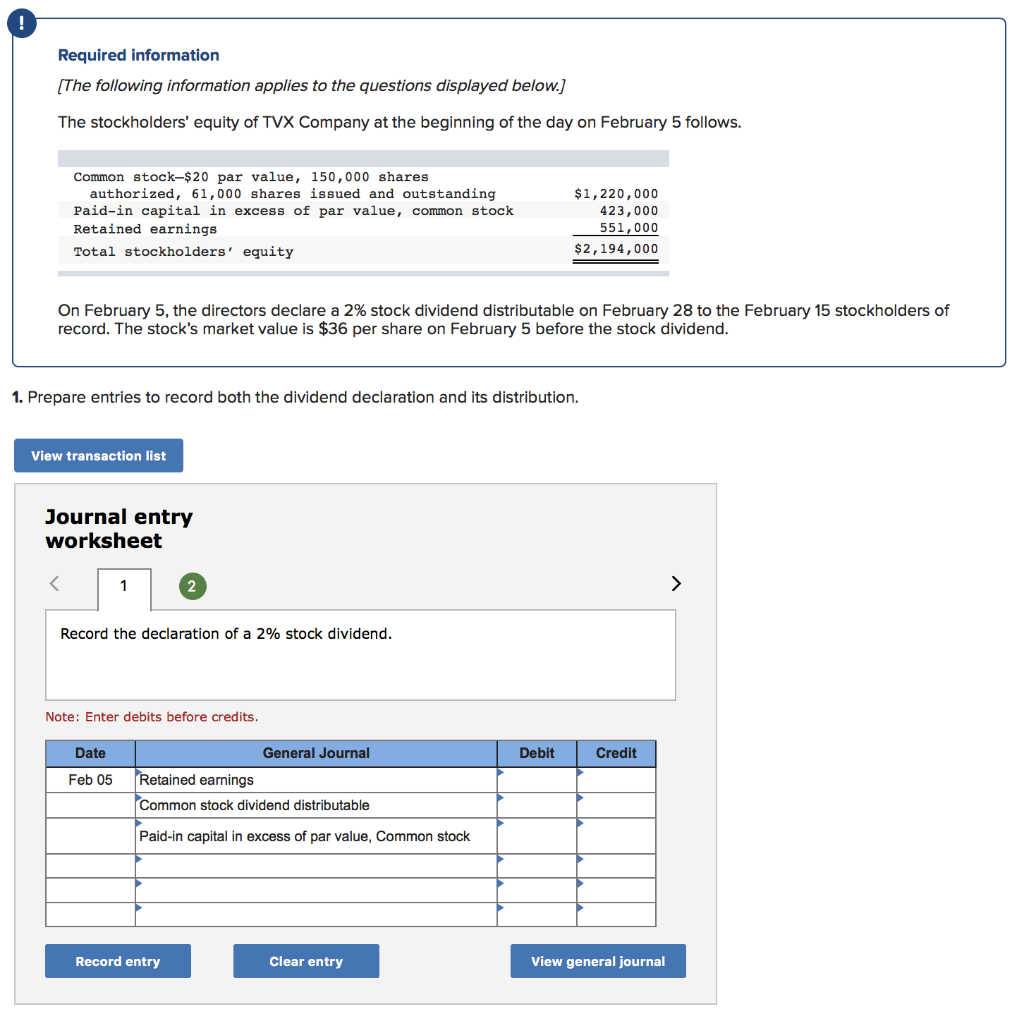

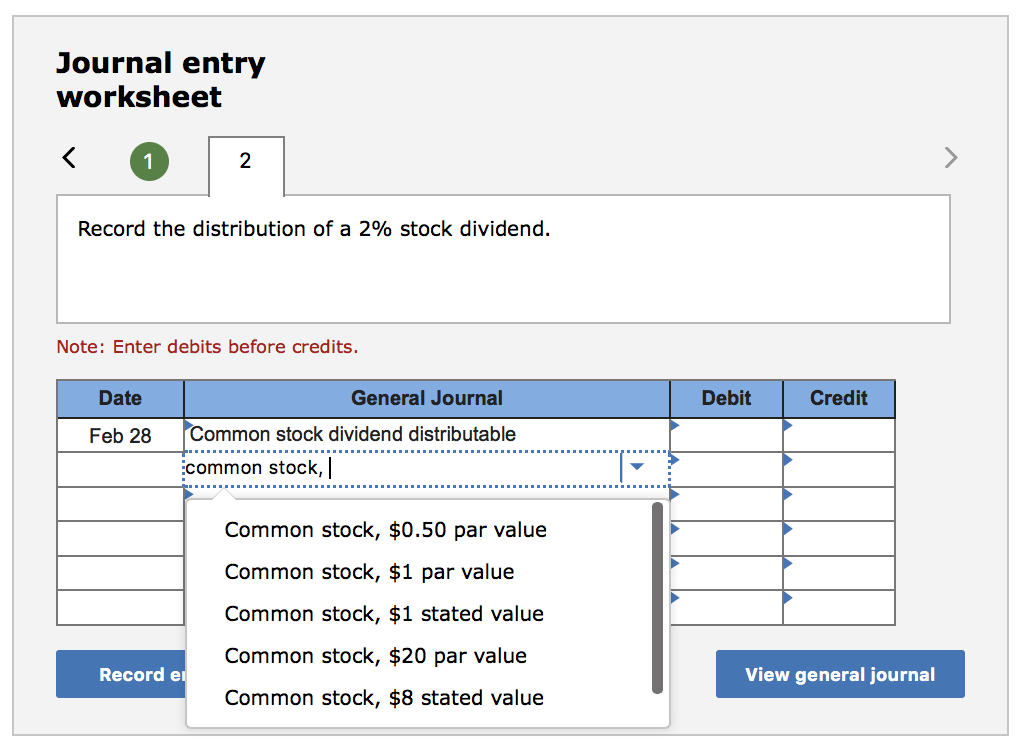

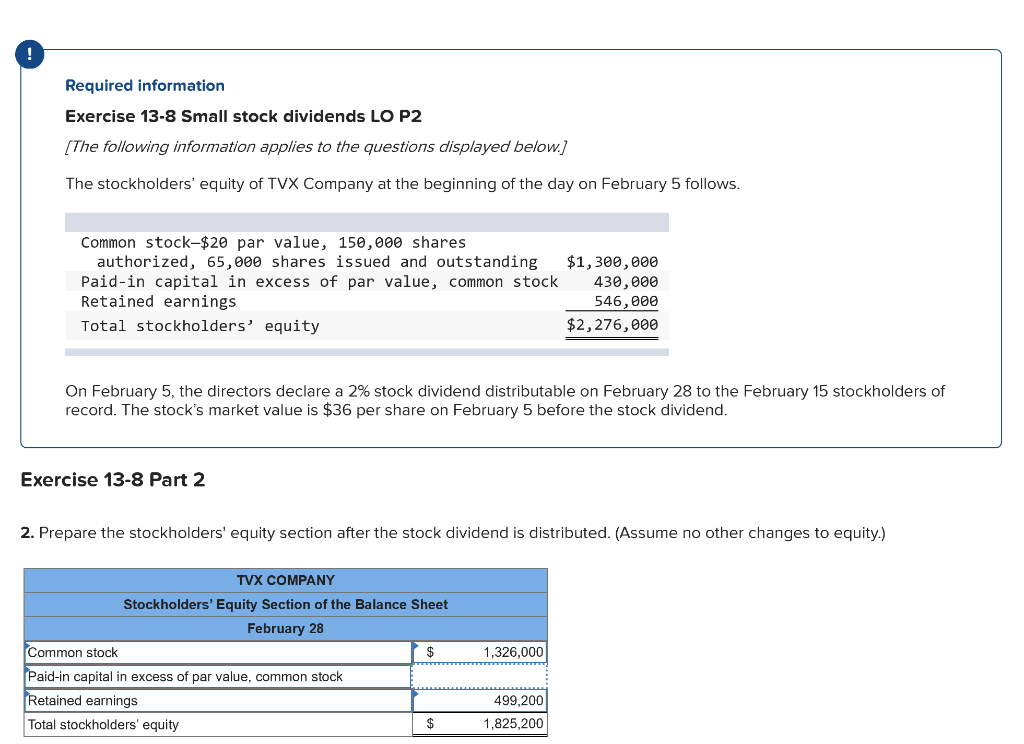

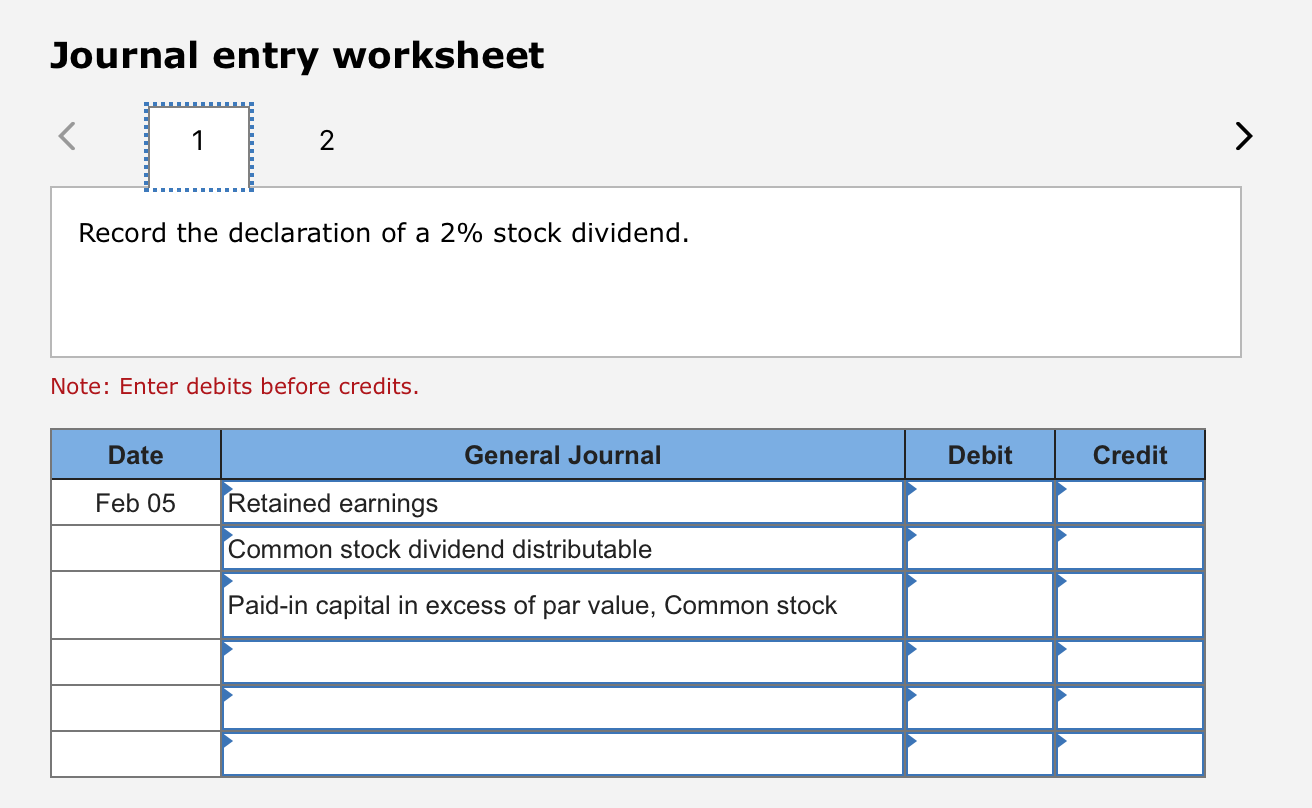

Retained earnings is reduced by 800 to reflect the market value of the 100 shares distributable as all dividends come out of retained earnings even stock dividends. Credit Common stock dividend distributable 120000 Credit Paid-in capital in excess of par value common stock 360000 On February 5 the directors declare a 20 stock dividend distributable on February 28 to the February 15 stockholders of record. An alternative definition is that this is a dividend payable in the corporations common stock rather than in.

Accounts and Explanation Debit Credit Dec. Declared an 8 common stock dividend when the market value of the stock was 450 per share. At the time of the stock dividend the market value per share was 20.

On November 2Finsbury Inc. Par value of shares to be distributed 40000 shares x 1 40000 7. A liquidating dividend is paid from contributed capitalrather than from earned capital retained earnings.

Multiply the product from Step 2 by the par value of the stock. An unrealized gain or loss on trading securities is reported as a separate component of stockholders equity. Credit Common Stock Dividend Distributable.

The entry to record this dividend is. The number of shares that a corporations charter allows it to sell. This about depreciation of fixed assets.

Thoroughly answer the following questions about depreciation. You just studied 17 terms. Between the time of the companys declaration and the actual issuing of dividends the company would list 7500 as.

This is the amount of stock dividends that will be issued to stock holders. Premium on Bonds Payable. Common stock par value 1 1000 shares outstanding.

Common Stock Dividends Distributable for 144000. Why is it used. Common Stock no par value 500000 shares issued 1500000.

Once declared this amount is classified as a liability of the corporation. Prepare entries to record both the dividend declaration and its distribution. Additional paid-in capital Fair market value Par value 360000 40000 320000 2 When shares are issued for stock dividends On February 25 202 Entity A issued 40000 shares of common stock for the stock dividend declared on January 25 202.

Continue to order Get a quote. In this example you would multiply 001 times 750000 to get 7500. Issuing a stock dividend instead of a cash dividend may signal that the company is using its cash to invest in risky projects.

Issued 50000 shares of 1 par value common stock for a total of. A Debit Retained Earnings 53200. Common stock dividend distributable 20440 common.

Record debits first then credits. On January 12 2021 When the company ABC distributes the stock dividend on January 12 2021 it can make the journal entry as below. The common stock dividend distributable account is a stockholders equity paid-in capital account credited for the par or stated value of the shares distributable when recording the declaration of a stock dividend until the stock is issued to shareholdersSince a stock dividend distributable is not to be paid with assets it is not a liability.

Paid-in capital in excess of par from stock dividend distributable. A corporation had 14000 shares of 10 par value common stock outstanding when the board of directors declared a stock dividend of 5320 shares. What exactly is depreciation.

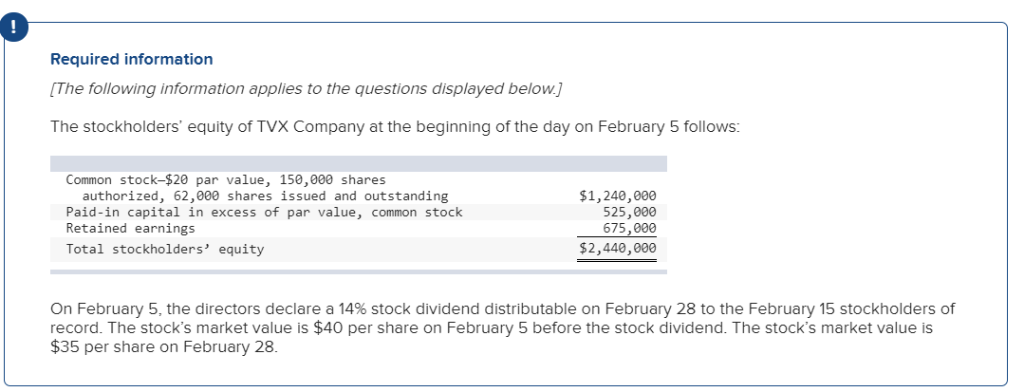

The stocks market value is 40 per share on February 5 before the stock dividend. Likewise the common stock dividend distributable is 50000 500000 x 10 x 1 as the common stock has a par value of 1 per share. Common Stock Dividend Distributable 20440 Common Stock2 Par Value 20440 Issued 14 stock dividend.

Now up your study game with Learn mode. On February 5 the directors declare a 20 stock dividend distributable on February 28 to the February 15 stockholders of record. The dividend Stock Dividends Distributable is listed as part of paid-in capital.

Record the declaration of a 20 stock dividend. 20 Stock Dividends Common Stock Dividend Distributable Paid-In Capital in Excess of Par- Common Declared an 8 stock dividend. Journalize the declaration and payment of the cash dividend.

Chapter 13 Final Exam The costs of bringing a corporation into existence including legal fees and promoter fees. Best simple stock app common stock dividend distributable use which par value. Common Stock Dividends Distributable.

Stock Dividends market value Common Stock Dividends Distributable par value APIC CS any excess o Note.

At September 30 The End Of Beijing Company S Third Quarter The Following Stockholders Equity Accounts Are Homeworklib

Accounting Q And A Pr 13 4a Entries For Selected Corporate Transactions

Solved Required Information The Following Information Chegg Com

15 Chapter Stockholders Equity Intermediate Accounting 12th Edition Ppt Video Online Download

Record Transactions And The Effects On Financial Statements For Cash Dividends Property Dividends Stock Dividends And Stock Splits Principles Of Accounting Volume 1 Financial Accounting

Solved Required Information The Following Information Chegg Com

Stock Splits And Stock Dividends Accountingcoach

Solved On February 5 The Directors Declare A 14 Stock Chegg Com

Required Information The Following Information Applies To The Questions Displayed Below The Stockholders Equity Of Tvx Homeworklib

Accounting Q And A Ex 13 10 Entries For Stock Dividends

Solved The Stockholders Equity Of Tvx Company At The Chegg Com

Chapter 15 Stockholders Equity Intermediate Accounting 13 Th

5 10 Dividends Financial And Managerial Accounting

Solved The Stockholders Equity Of Tvx Company At The Chegg Com

11 Reporting And Analyzing Stockholders Equity Ppt Download

15 Chapter Stockholders Equity Intermediate Accounting 12th Edition Ppt Video Online Download

Comments

Post a Comment